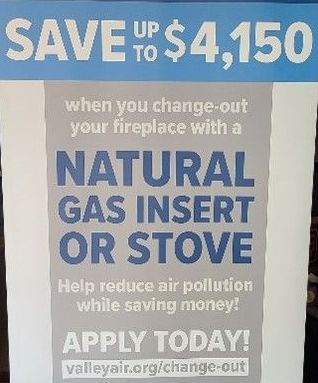

BurnCleaner Rebates

Replace your older wood-burning stove or close off your open fireplace with a new cleaner-burning product, and you could be compensated up to $4,150!!!! You will receive a $2,650 rebate if you purchase a new gas heater-rated product to replace an old wood insert or stove or to close off an open fireplace. Qualifying low-income households or households that reside in high pollution hotspots may receive up to $4,150.

Fireplace & Woodstove Change-Out

TAX CREDIT:

Call Us Today for Details on the

BIOMASS STOVE TAX CREDIT

Federal Biomass Stove Tax Credit

Applicable systems, whether they are stoves purchased to heat space or larger, whole-home heating systems, will now qualify for a renewable energy investment tax credit (Section 25(D) of the Internal Revenue Code). Beginning in 2021, consumers buying highly efficient wood or pellet stoves can claim a 26% tax credit. The credit will remain at 26% through 2021 and 2022, and then step down to 22 percent in 2023. This provision applies to residential biomass heating equipment that are at least 75% efficient and purchased before December 31st, 2023.